The Truth Behind Real and Fake Money: Understanding Financial Integrity

In the fast-paced world of finance, understanding the distinction between real and fake money is not just a matter of curiosity; it is essential for maintaining the integrity of business operations. This article delves deep into the various aspects of money, exploring its roles, implications, and the critical need for businesses, especially in the realms of financial services, legal services, and financial advising, to safeguard against counterfeit currency.

What is Real Money?

Real money refers to currency that is legally accepted for transactions within a country. It possesses inherent value and is typically backed by the government or central bank. The characteristics of real money include:

- Physical currency: Coins and banknotes that are printed and minted by authorized financial authorities.

- Digital currency: Money that exists in electronic form, such as credit and debit cards, and cryptocurrency.

- Legality: Recognized by law as a means of payment for goods and services.

- Stability: Maintained value over time, backed by the economic stability of the issuing country.

The Dangers of Fake Money

On the contrary, fake money or counterfeit currency is any form of currency that is produced without legal sanction and carries no real value. The proliferation of fake money poses severe risks, including:

- Economic impact: Counterfeit money can lead to inflation as it increases the money supply without backing.

- Loss of trust: Businesses and consumers may lose confidence in currency systems, affecting economic stability.

- Legal ramifications: Possession or circulation of fake money can lead to serious legal consequences, including imprisonment.

- Financial crimes: Counterfeit money is often tied to organized crime, impacting societal safety.

The Importance of Recognizing Real and Fake Money in Business Transactions

As businesses engage in transactions daily, the risk of accepting fake money inadvertently increases if proper measures are not in place. Here’s why understanding the difference is crucial:

Protecting Business Assets

Accepting counterfeit currency directly impacts a business's bottom line. Every bill of fake money taken during transactions results in a financial loss that can accumulate over time. By implementing strict verification processes, businesses can mitigate these risks.

Legal Compliance

Financial institutions and businesses are legally obligated to prevent the circulation of counterfeit currency. Non-compliance can lead to hefty fines and legal battles, distracting management from core business operations.

Consumer Trust

Customers are more likely to engage with businesses that prioritize economic integrity. Establishing systems that guarantee authentic transactions can foster trust and build robust customer relationships.

Techniques for Identifying Real and Fake Money

Given the importance of distinguishing between real and fake money, businesses and individuals must be equipped with the right tools. Here are effective techniques to identify counterfeit currency:

Visual Inspection

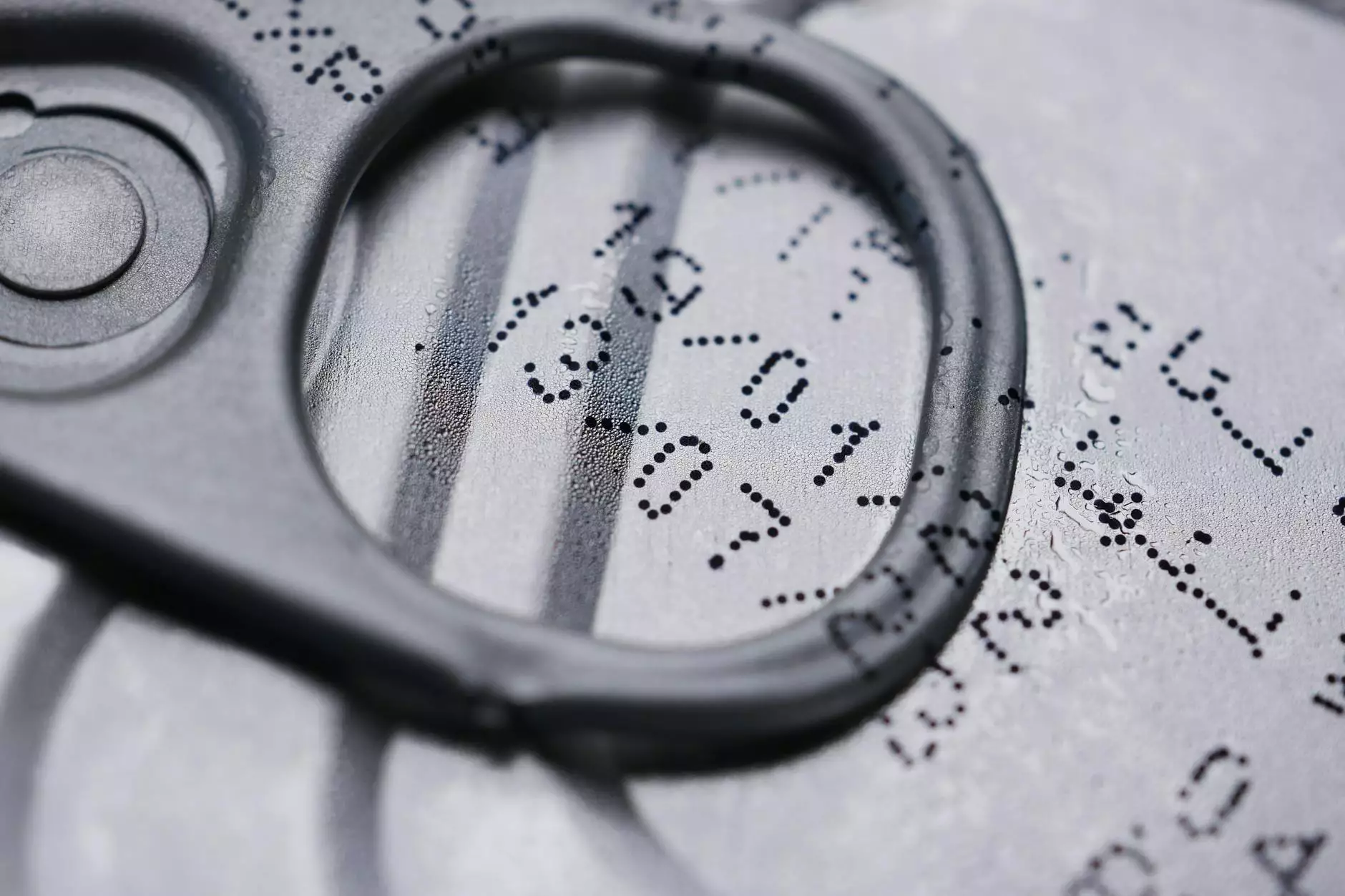

A thorough visual inspection can reveal a lot. Key aspects to check include:

- Watermarks: Authentic bills often have watermarks that are not readily visible without careful inspection.

- Color-shifting ink: Look for ink that changes color when tilted.

- Texture: Real currency has a distinct texture that feels different from counterfeit notes.

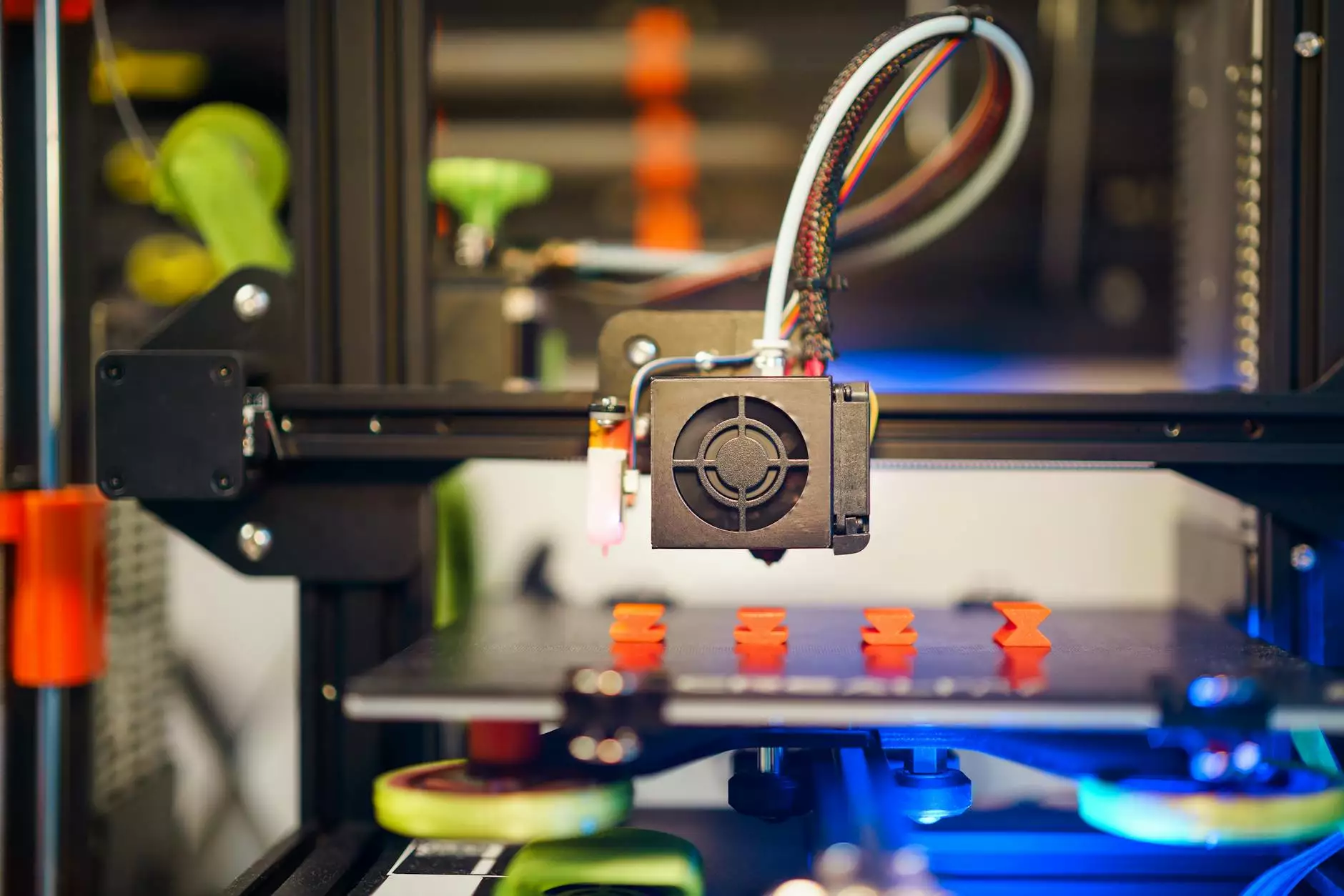

Using Technology for Verification

Modern technology provides various tools for detecting counterfeit money. Devices such as:

- Ultraviolet (UV) scanners: These highlight security features only visible under UV light.

- 磁性检查: 技术检测特殊墨水的磁性,以确定货币是否合法。

- 智能手机应用程序:许多应用程序允许用户扫描并验证纸币的真实性。

Training Employees

Investing in training programs for employees can greatly enhance their ability to recognize real and fake money. Providing employees with resources and knowledge empowers them to make informed decisions during transactions.

The Role of Businesses in Combating Counterfeit Currency

Businesses play a pivotal role in the fight against counterfeit currency. Here are a few initiatives they can adopt:

Implement Robust Payment Systems

Utilizing secure payment systems that incorporate advanced technologies can significantly reduce the incidence of counterfeit transactions. Digital payments, which are harder to counterfeit compared to cash, are an effective alternative.

Regular Audits and Compliance Checks

Conducting routine audits ensures that businesses remain compliant with legal standards and minimizes the risk of inadvertently accepting fake money. Consistent checks can aid in immediately identifying any discrepancies in currency handling practices.

Collaboration with Law Enforcement

Creating a partnership with local law enforcement can enhance a business's capabilities in identifying and preventing counterfeit currency circulation. Reporting incidents and sharing knowledge regarding counterfeiting techniques can strengthen community efforts against this menace.

Conclusion

In conclusion, the distinction between real and fake money is a vital aspect of maintaining financial integrity in any business environment. Understanding the implications of counterfeit currency and being equipped with the right tools and strategies is fundamental, especially for those operating within financial services, legal services, and financial advising. By taking proactive steps to identify and combat counterfeit money, businesses can protect their assets, adhere to legal standards, and foster trust with their consumers.

To ensure your business's success in today's economic landscape, invest in proper training, utilize available technologies, and remain vigilant against the threats of counterfeit currency. Your financial future relies on your ability to discern between real and fake money, forging a path towards integrity and success in all ventures.